On November 27 the Reserve Bank reduced their Official Cash Rate by 50 basis points to 4.25 per cent.

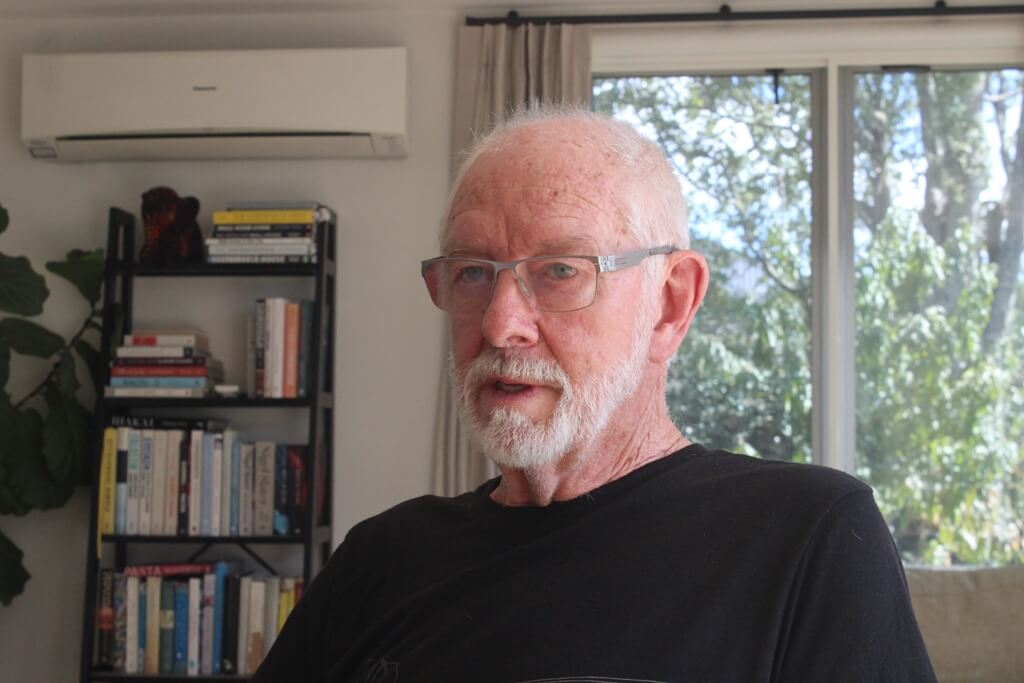

Peter Nicholl

This was what most market participants had been expecting, though a few were hoping for a bigger cut of 75 basis points. Most banks reduced their mortgage and deposit rates in response, though not many by 50 points.

The bank’s next decision will be in on February 19.

It argues pre-announcing dates for Official Cash Rate decisions a year ahead gives financial markets and borrowers certainty.

I think all it does is force people to worry and try to anticipate what the bank will do. I was involved in making monetary policy decisions in the Reserve Bank for about 15 years.

From my experience, the best time to make policy decisions doesn’t fit into any pre-announced timetable.

The Bank seems to think inflation and financial markets go on holiday over our summer, but market shocks can happen at any time.

So instead of the usual gap 6-7 weeks between cash rate decisions, we must now wait 12.

One good thing about this gap is the bank will see the Consumers Price Index (CPI) outcome for the year to December. That outcome could be important.

Most economic commentators have recently been using expressions like ‘it is good that inflation is finally under control in New Zealand’. I worry that they could be claiming victory a little early when we have only had one CPI figure within the Reserve Bank’s 1-3 per cent target range.

That figure hit the range because traded-goods inflation was negative. Non-traded goods inflation, the bit we largely produce ourselves, was still over 4 per cent.

Since our September CPI data, news about inflation stimuli overseas has largely been negative. There is Trump-era tariffs and tax cuts and continued instability in the Middle East and Eastern Europe. Global financial markets have started pricing in increases in global inflation over the medium-term.

The Reserve Bank in their November statement raised the level of the Official Cash Rate’s ‘terminal level’ – the level the cash rate could fall to at the bottom of this cycle, to just over 3 per cent. That implies there is still more lowering of the cash rate to come – and it not going to drop anywhere near the 0.25 per cent it was at from March 2020 to August 2021.

We need to remember that the adoption of unconventional monetary policies of extremely low interest rates and huge amounts of liquidity creation by most central banks, including the Reserve Bank, during that period was what triggered the inflationary cycle the world has been going through recently.

I hope the Reserve Bank’s specification of a ‘terminal level’ of the Official Cash Rate around 3 per cent means they have ruled out any repeat of the huge mistakes they made in 2020 and 2021. But I may be being optimistic. The bank has never admitted they made any mistakes in those years.