The issue of whether or not New Zealand needs to introduce a capital gains tax is back in the news.

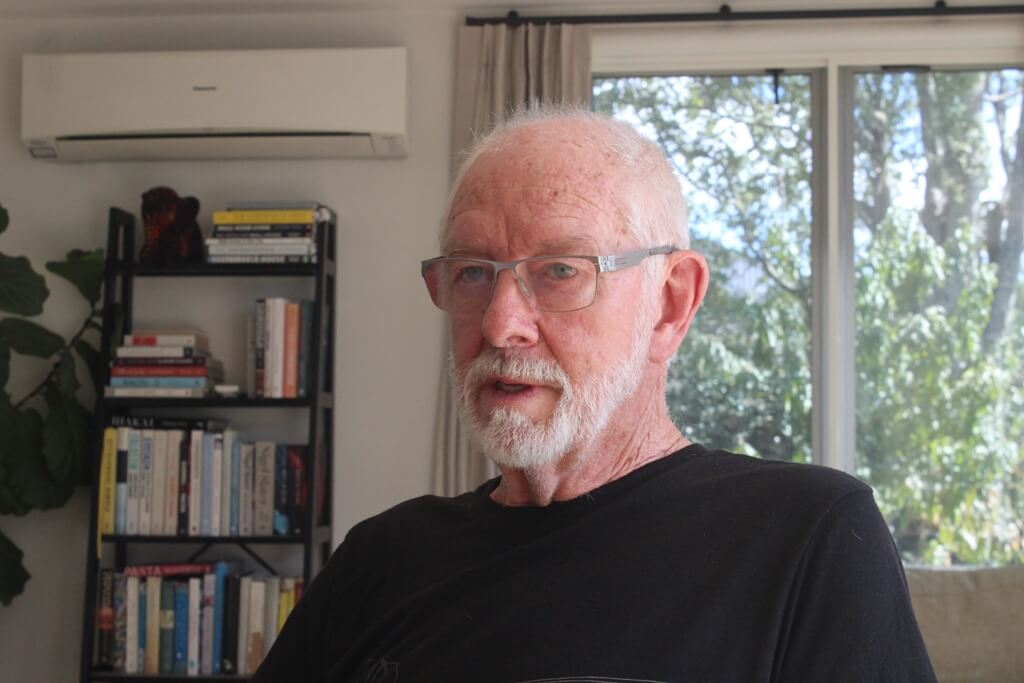

Peter Nicholl

A recent survey by Ipsos said 65 per cent of 1000 respondents would support a capital gains tax in some form. There was substantially less agreement on what should be taxed.

A month earlier, the NZ Herald Mood of the Boardroom survey had 77 per cent of the 100 business leaders surveyed saying the Government needs to introduce a capital gains tax. They gave both economic and equity reasons for their views.

The IMF and the OECD in their reports this year said New Zealand needs to broaden its tax base by introducing a capital gains tax.

The chief executive of ANZ Bank and the departing Head of the Treasury have also publicly supported its introduction.

This got me thinking about what New Zealand thinks it is gaining by being one of the few developed countries in the world to not have a capital gains tax. We are an exception. What does the country gain from that?

One advantage often cited for not having a capital gains tax is that it encourages investment. But our overall investment record is relatively poor. The lack of a capital gains tax can also distort investment decisions towards areas where capital gains are regarded as being strong and reliable, such as housing.

This argument for why New Zealand is one of the few exceptions in this area doesn’t look very strong.

A related argument for not having a capital gains tax is that it will encourage more foreign investment, but our record in this area has also been relatively poor.

This argument for not having a capital gains tax doesn’t seem to be very strong either.

Another argument against capital gains taxes is that they deter risk-taking and this isn’t good for an economy.

Most countries in the world have some form of capital gains taxes and they still have risk-taking and economic growth that is better than our recent record. Another argument is that such a tax will make the tax system more complicated and generate more work for accountants and lawyers. There is some truth in this argument and careful design of a capital gains tax system would be very important.

If readers can think of anything that New Zealand gains by being one of the few countries not to have a capital gains tax I would like to hear them. I could easily have missed something but can’t see what we have gained.

On the other side of the debate, when one looks at the huge problems NZ has in many important infrastructure areas such as schools, hospitals, roads and power it is hard to see how the country is going to solve any of these infrastructure problems without a broadening of the tax base.

The NZ population is also ageing. The fiscal consequences of this will need to be addressed either by expanding the tax base or changing the entitlement criteria – or probably it will need a mix of both policies.