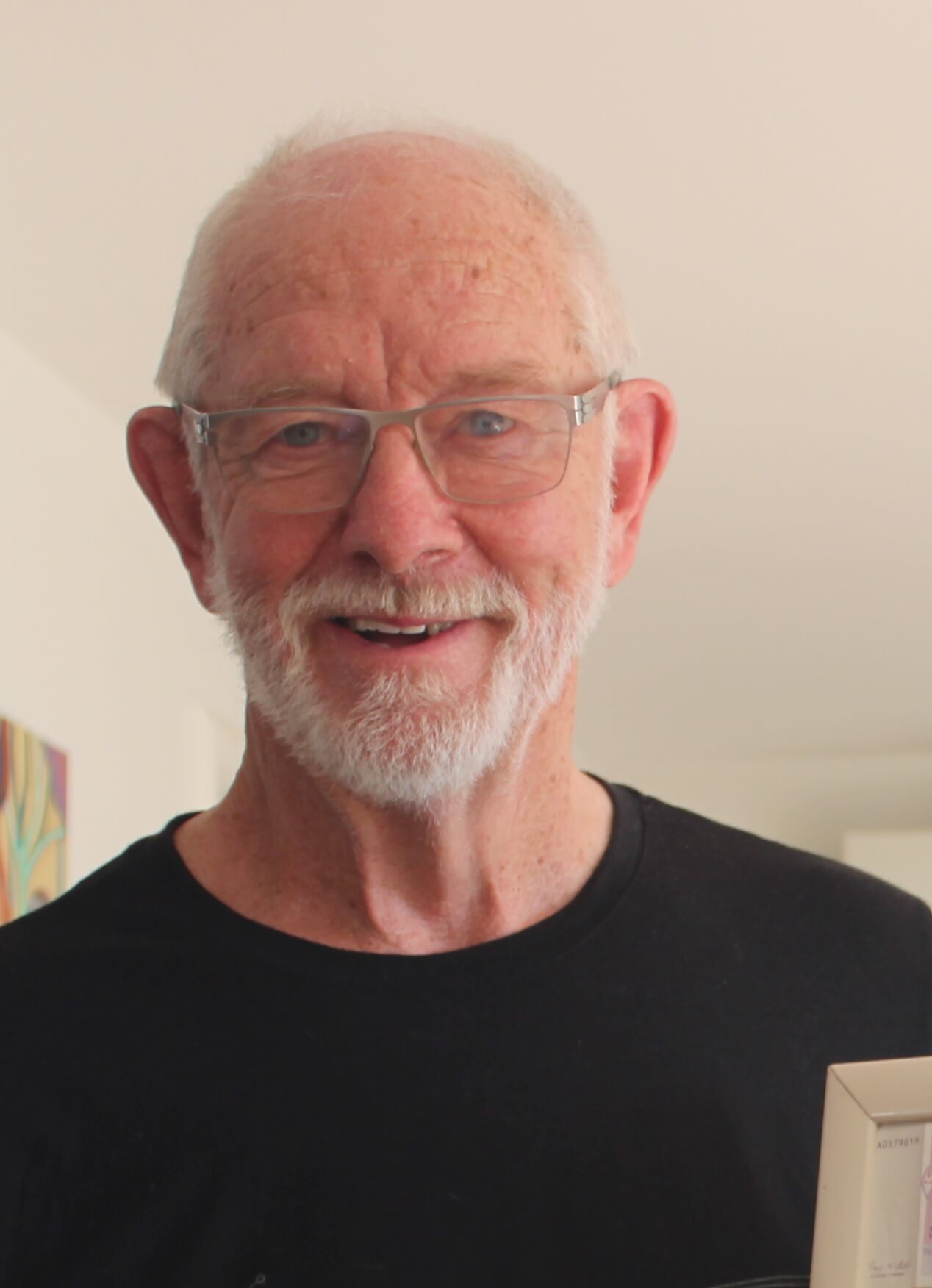

Peter Nicholl

The Commerce Commission has recently published its report into competitiveness in the New Zealand banking system. Their focus was on personal banking services. Their study took 14 months, and their report was 382 pages long. I have to admit I only read the report’s executive Summary, which was a much more manageable eight pages.

Peter Nicholl

The commission concluded that New Zealand has a two-tier banking system with the four big banks, ANZ, ASB, BNZ and Westpac, comprising tier-one and acting as an oligopoly. The definition of an oligopoly is “a state of limited competition in which the market is shared by a small number of participants”.

The combined market share of the big four banks has been close to 90 per cent for a long time and their respective market shares have not changed a lot either. So our banking sector certainly fits the definition of an oligopoly. Kiwibank sits between the two-tiers and does impose some competitive constraints on the larger banks but lacks the scale or capital to do a lot.

The analysis in the report is okay but most of their recommendations are likely to have little impact on banking sector competition. They put a lot of stress on the potential competitive impacts of “open banking”. Open banking gives customers the ability to share their banking data, including all of their transactions data, with third-party providers such as Fintech companies. The expectation (hope) is that this will allow customers to get better-suited and cheaper products and to switch banks more easily. Open banking has become a buzz phrase. Its promoters attach large potential benefits to it.

But open banking has been available in the United Kingdom and Australia for a few years already.

A recent review of its progress in UK concluded that the open banking regime had flopped. The reasons they gave for this is that there is insufficient demand for open banking services from both customers and Fintechs.

Customers are nervous about sharing their banking data with companies they don’t know well. Consumers worry about just how open their data could become. Most new UK Fintech firms have struggled to grow and make a profit. I have been told that the few new firms that did make progress in Australia were then bought out by the banks.

I am not sure why our Commerce Commission thinks open banking will have a bigger impact in NZ than it has so far done in the UK and Australia.

“There is some thinking and terminology in the report that worries me. For example, it says there is currently no maverick in the sector – they describe a maverick as a “particularly aggressive or innovative provider”. In several places it says there is need for disruptive innovation. Elsewhere, it says competitors should be constantly trying “to injure each other”.

We need to be careful what we wish for. These sorts of market behaviours may be fine in many markets, but they could be very risky and expensive in a country’s banking sector.

From my experience of working on banking supervision issues in a number of countries overseas, maverick banks have an unfortunate tendency to collapse, and banking sector collapses have an unfortunate tendency to cost citizens and governments a lot of money. This makes the banking sector different from most other sectors.