Spiralling debt. Photo: Mikhail Nilov.

A Cambridge Community Board member has taken a swipe at Waipā District Council for championing debt rather than reducing rates’ inflation.

Cambridge News 12 September 2024

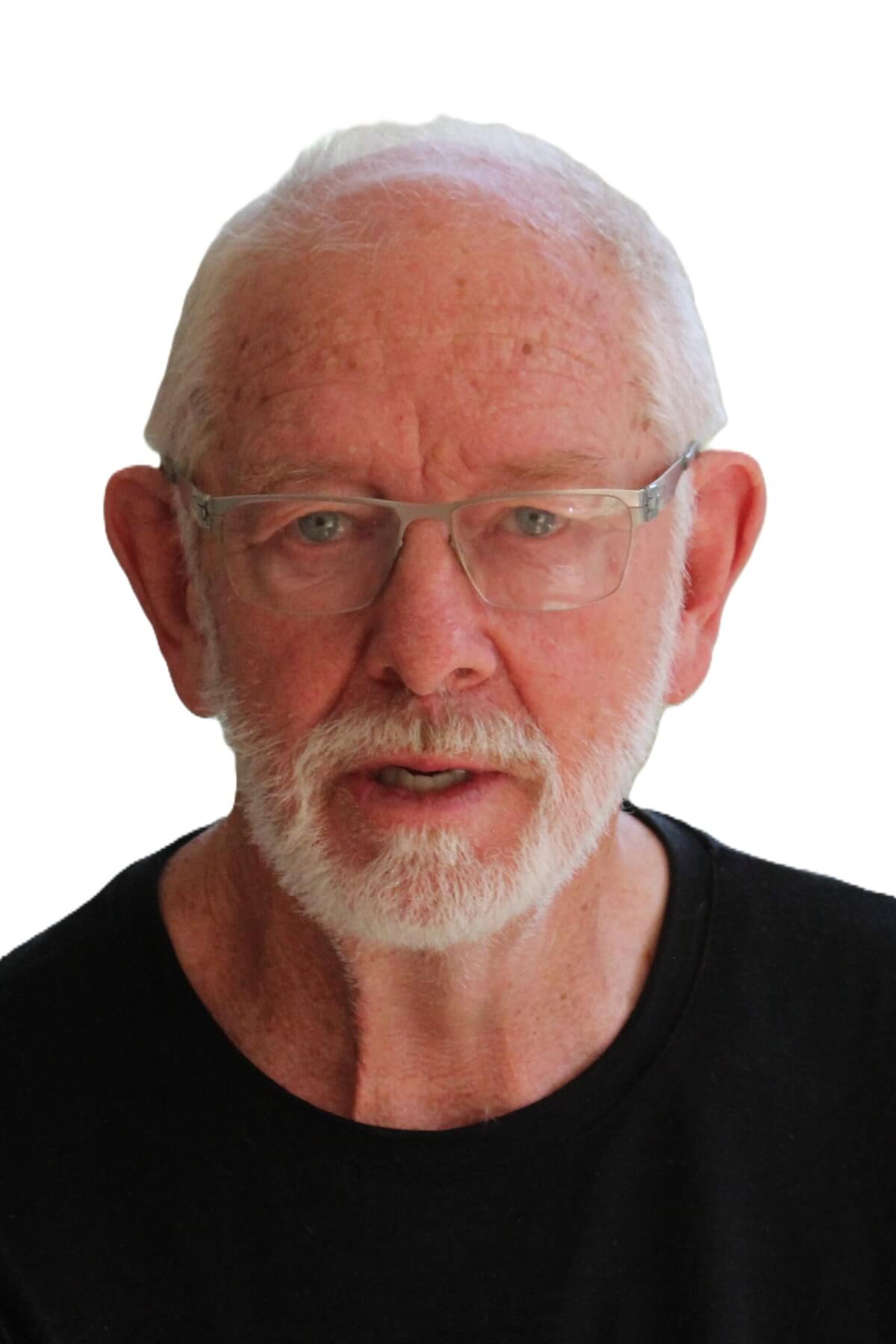

Andrew Myers, who is also a member of the Fonterra co-operative council, was responding to a media release Waipā put out last month – which The News chose not to publish but other media outlets published in full.

Andrew Myers

In it, the council said it was set to net nearly $400,000 profit in a low-risk arbitrage deal.

Arbitrage is the simultaneous purchase and sale of the same asset in different markets to profit from a difference in its price.

Deputy chief executive Ken Morris said the council had borrowed $50 million from the Local Government Funding Agency and then invested it in term deposits at the ANZ and BNZ banks at a higher rate than what it had borrowed it for.

The council would pocket $384,000 when the deals matured in April, he said.

Ken Morris

But Myers, a dairy farmer who represents the Maungatautari ward on the community board, said the council was at its debt ceiling and the media release should have focussed on the position of overall debt and the growing debt burden.

“Explaining why we need more debt and how we plan to reduce debt over time would be very helpful,” he said.

Waipa council has estimated its debt at the end of the current financial year ending June 30 will be nearly $400 million. Earlier this year international rating agency Fitch reaffirmed the council’s credit rating as AA-.

But in a move which is bound to spook Waipā, Hamilton City Council’s rating was downgraded from AA- negative to A+ negative watch. The outlook on the long-term rating was negative, S & P Global Ratings said.

“The negative outlook on the long-term rating reflects the weakening institutional settings in New Zealand’s local government sector,” the rater said.

When the Waipā council term deposit expires the loan would incur interest costs of at least $400,000 a year, said Myers.

“Assuming the loan will be on the books for many years, how can we write a story about profiting from a loan when in fact, like any loan, it will cost money, from next year, and for many years thereafter?

“Interest costs add to a rates burden that isn’t under control. I feel it would be prudent in this economic position to not champion debt. More explanation of how we are going to reduce rates inflation would be a good counter to the released statement.”

Peter Nicholl

The News economic columnist Peter Nicholl agreed saying it seemed too good to be true. The council had pre-funded future debt requirements, he said.

“From my experience, such opportunities seldom exist in established markets and if they arise because of a sudden movement in one interest rate, they disappear quickly.”

Nicholl worked for the New Zealand Reserve Bank for 22 years where he was chief economist, deputy governor and deputy chief executive.

He went on to become an executive director on the World Bank board and governor of the Central Bank of Bosnia and Herzegovina.

“When the deposits mature, the loan won’t be paid back, and the arbitrage deal completed. The loan will stay in place and the funds spent but probably not all at once,” he said.

“If the council don’t need to use all the $50 million immediately, they will need to put some of it back on deposit.

“Deposit interest rates will be lower by then. If they are lower than the borrowing rate that Waipā has ‚locked-in, this year’s arbitrage profit will turn into a loss next year,” he said.

Waipā had prefunded future spending which would not occur before the end of April.

“Borrowing costs are almost certain to fall between now and next April. If borrowing costs are one per cent lower next April, then the rate Waipā is paying… will cost (the council) $500,000 more to finance the $50 million of debt than if they had waited and borrowed the funds when they needed them.

“Either way, there is a good chance that this year’s gains from the arrangement will be reversed next year,” said Nicholl.

“You can only tell if it is a good deal when both sides of the transaction are complete.”

- What do you think? Email [email protected]

Rising debt levels? Photo: Artem Podrez pexels.com