James Atkinson

A record number of dairy farmers and rural professionals have turned out for a milk price hedging workshop.

Thirty-two people showed up for the workshop at Fonterra Farm Source, Cambridge, a larger turnout than previous workshops in the Waikato, Taranaki, and the South Island.

“Farmers are becoming more interested, which is really positive, interest has been growing pretty rapidly over the past three” said NZX derivatives sales manager James Atkinson said.

More than 20 per cent of New Zealand milk produced by just under five million dairy cows in more than 11,000 dairy herds is being managed via milk hedging tools.

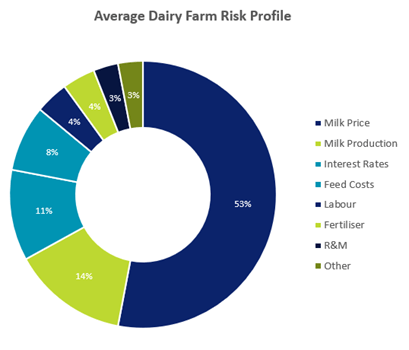

Milk price makes up more than half of an average dairy farm’s risk profile when looking at different costs and revenue streams on farm from season to season.

James Atkinson

A pie chart shows milk prices make up more than half of a dairy farm’s risk profile.

Fonterra dairy farmers have been able to use fixed milk price tools since 2019. Futures and Options have been available since 2017, however, they have seen more uptake from farmers over the past few years. Milk price hedging uses financial instruments such as futures contracts and options or processor fixed contracts to hedge against fluctuations in milk price driven by climactic, economic, and political factors. Futures can be used to lock in a milk price for a future season.

“Farmers pay an initial margin upfront which generally decreases over the life of the future position as volatility reduces and the milk price becomes more known,” Atkinson said. “The variation margin is marked daily to the futures market price.”

Options are like insurance, Farmer pays a premium up front, to protect them from a falling milk price.

“Options protect against downside risk in milk price and can be an effective tool for farmers who want to set a price floor,” he said. “There are a number of strategies farmers can use with Options.”

“The ’24 season milk price futures dropped to as low as $6.70 per kilogram of milk solids then peaked above $10.30 throughout the life of the contract. Every season can be volatile.”

Fonterra’s May 29 forecast was between $7.70 and $7.90.

“Fixed milk price is a handy way to get farmers started in the education. They can build from that to other products and tools.”

“A lot of other businesses use these sorts of tools to lock in the margin and lock in profit.”

“Farmers use the tools for hedging purposes, which means to manage their price risk and manage their business more effectively. So, if you can lock in margins above costs on farm that can build resilience within a business. It’s for managing milk price risk.”