Road cones

The Reserve Bank of New Zealand speech on January 30 didn’t shine much light on what the bank might do with the Official Cash Rate on February 28.

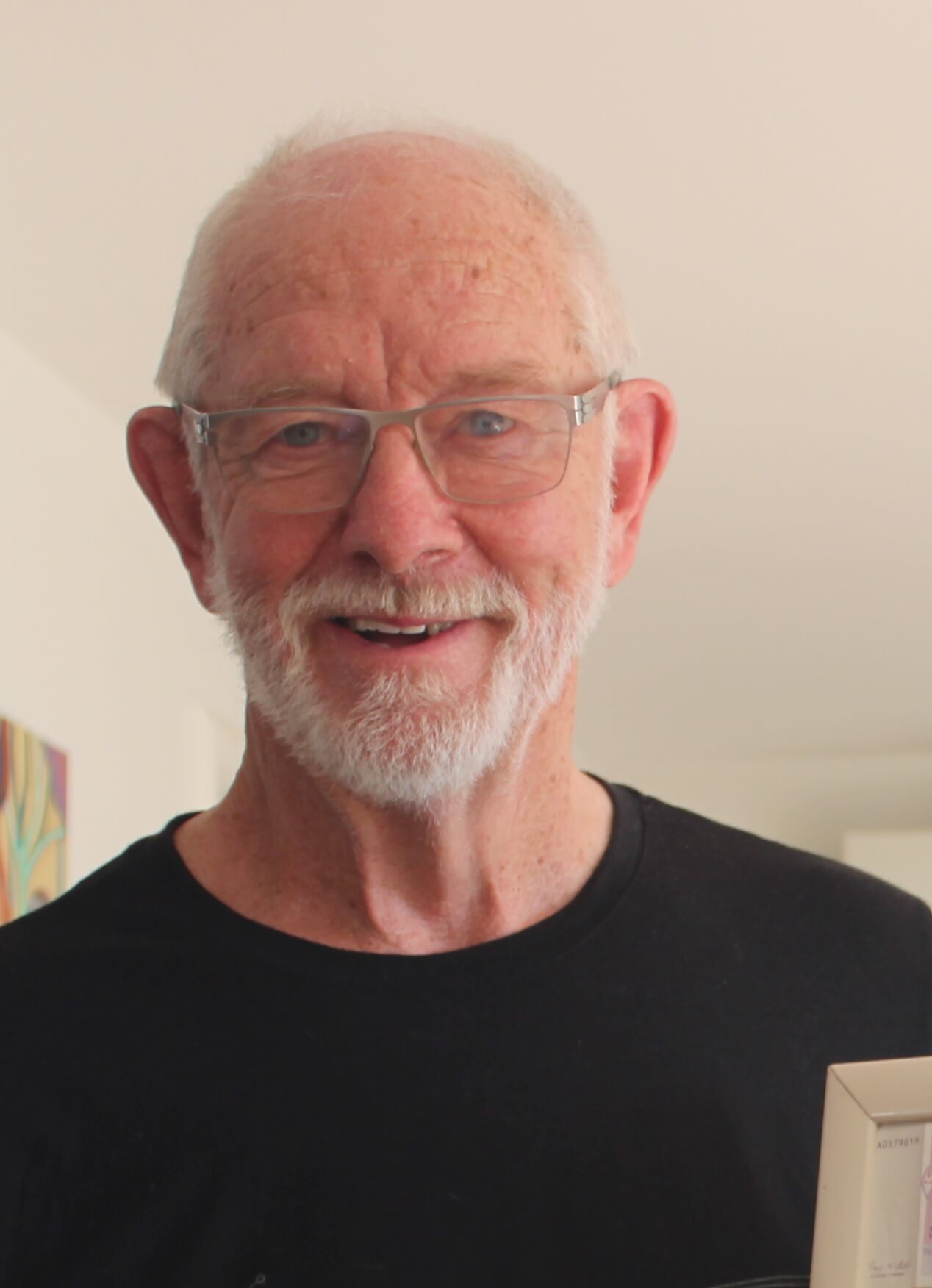

Peter Nicholl

So economists and bankers are still speculating. They don’t all have the same view – but when did economists ever manage to agree? Westpac Bank seem to be confident that the Reserve Bank will leave the cash rate where it is and that the next move in the rate will be down. They have recently reduced some of their mortgage and deposit interest rates. The ANZ bank economist on the other hand thinks there is a possibility that the most recent unemployment data might lead the Reserve Bank to be concerned that the economy is stronger than they expected and another rise in the OCR on February 28 may be necessary to bring inflation back to their target range.

I will be very surprised if the Reserve Bank does raise the cash rate. The unemployment figure did rise so the economy is moving in the direction the bank expects and wants. It didn’t rise by quite as much as they had predicted. But to make a cash rate move based just on that would be micro-management. The Reserve Bank needs to look at a whole host of information, both from here and overseas.

The overseas news on inflation is still predominantly positive. For example, the latest inflation data from China was actually negative (-0.8 per cent). They now have slight disinflation. What happens to prices in China will have a global impact because of their sheer size and their major role in global trade.

But as I said in my last column, it is domestically-driven inflation rather than imported inflation that is driving our consumer price index. That will require some sort of policy response. But I do not think another increase in the cash rate is the right response as many of our domestic inflation pressures are not market-driven. They are the result of excessive and poorly-designed regulations. We see examples of these costs every day. They are massive. For example, a pedestrian-crossing in Auckland that cost almost $500,000 got lots of publicity recently. What got very little publicity was that costs related to traffic management and health and safety were one-third of the total costs. This is not an isolated case.

There have been lots of letters to the Cambridge News recently about the proliferation of road cones around our town. They annoy people for all sorts of reasons. They annoy me because I look at road cones as a cost. And when I see more road cones being used than are necessary, it Is a wasted cost that adds to our price level and contributes nothing.

Regulatory costs are not impacted by interest rates so the raising of the official cash rate by the Reserve Bank will have absolutely no impact on them. The appropriate policy response to domestic inflation here is to hasten the review of regulations and their costs that the new Government has promised. To make it a serious and tough review it need to take actions not just write reports.

Cambridge Pathway Project with cones.