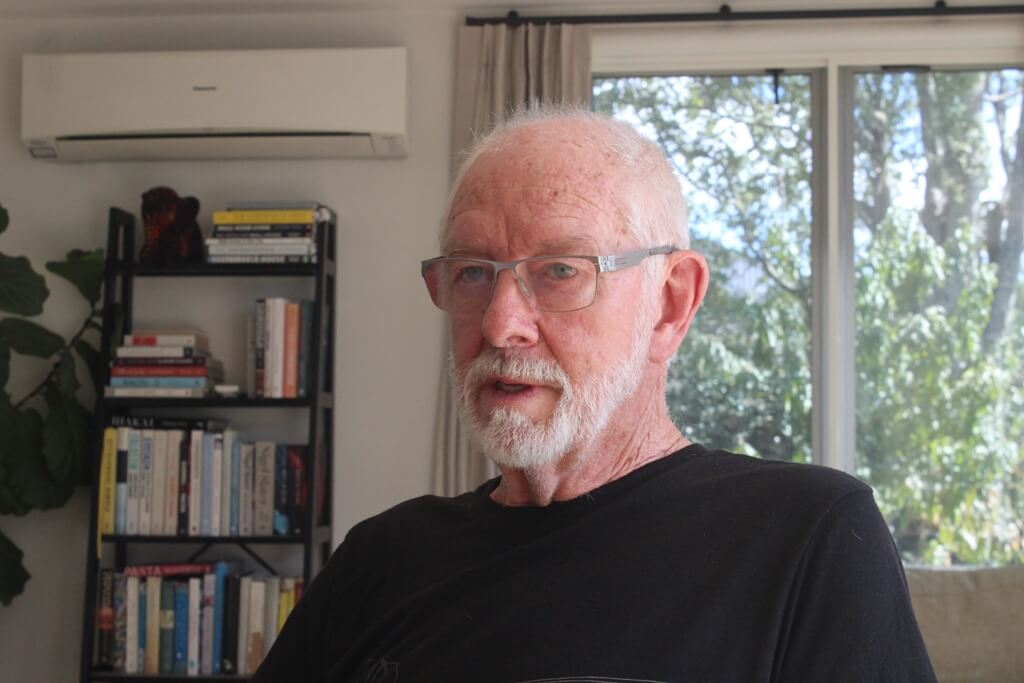

Peter Nicholl

On October 4 the Reserve Bank’s Monetary Policy Committee agreed to make no change in the Official Cash Rate and left it at 5.5 per cent.

I have been very critical of a lot of the committee’s decisions over the last few years. I am getting a bit worried now because this is the third cash rate decision in a row that I have agreed with.

Am I getting less critical or has the reserve bank improved? I think we will have to wait and see another one or two committee decisions before answering that question.

While inflation is not falling back towards the Reserve Bank’s 1-3 per cent target range as quickly as they would like, the Monetary Policy Committee thought the current level of interest rates was constraining economic activity and reducing inflationary pressures. They also said global economic growth was slower than many forecasters had been predicting and inflation rates were easing in most of our trading partners. The economic situation in China was particularly concerning.

However, because inflation rates were not falling as quickly as they had anticipated, the committee said that cash rate should stay at a restrictive level for longer. Market commentators took the slightly more hawkish tone of the announcement last week to mean that there was likely to be at least one more rise in the cash rate either in November or next February, the dates of the next two Official Cash Rate decisions. I don’t think there should be another rise for two reasons.

First, the Reserve Bank needs to continue to take account of the long lags in the impacts of changes in monetary policy. When I chaired the Monetary Policy Committee way back in the 1990s, we worked on the basis that the lag was around one year. The committee increased the cash rate by two percentage points in four changes between November 2022 and May 2023. Those changes have still not worked their way fully into mortgage rates. There are still a lot of fixed-rate mortgages that are yet to reach their roll-over date. The interest rates on these mortgages will rise sharply when they do.

Second, the news on the world economy is getting bleaker. Asia has been the world’s main growth engine for a long time. The World Bank has just forecast that in the next year, East Asia’s economies will expand at their lowest rate for 50 years – 50 years! The other growth engine at present is the USA and it is still growing more strongly than forecasters had expected. But when you look at the high debt levels in the USA and the circus that American politics currently is, it is hard to be confident that the USA won’t become a source of global instability in the near future.

The Reserve Bank eased monetary settings far too much in 2019 and 2020 and were far too slow to start reversing this excessive easing in 2021. These mistakes helped ignite the recent surge in inflation. They now need to be careful not to make a third mistake of going too far and adding to the downward pressures that already exist. Monetary policy is supposed to be counter-cyclical, not pro-cyclical.