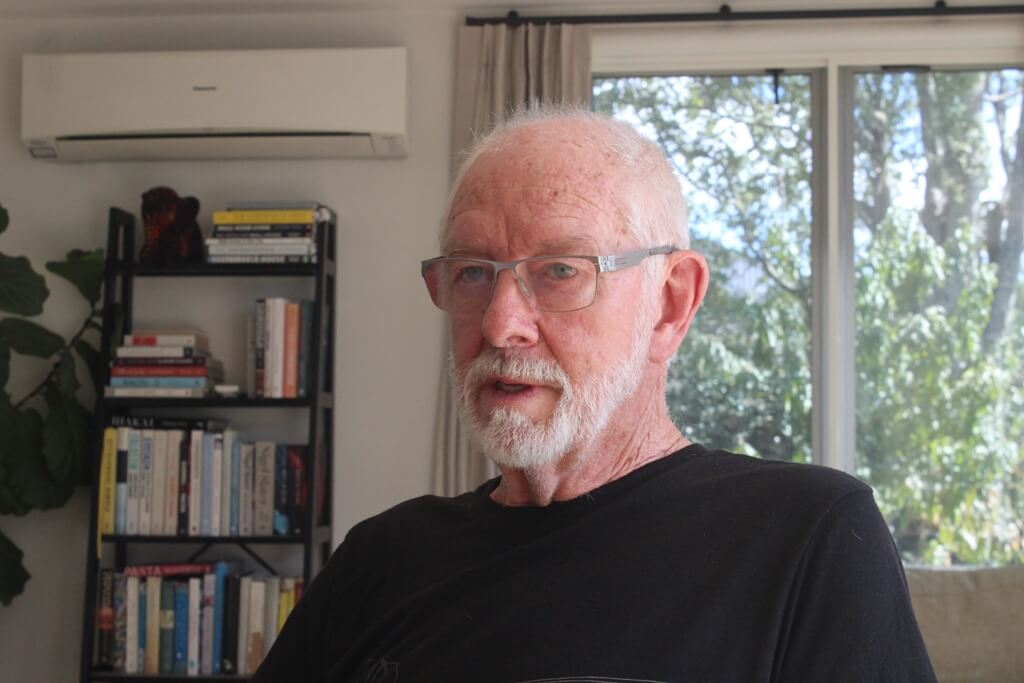

Peter Nicholl

If there was a budget blowout of $10 billion in the health or education areas, it would be the subject of intense criticism and recrimination.

There has been a $10 billion blowout in the cost of implementing monetary policy and it has received little attention and almost no criticism.

The Reserve Bank of New Zealand implemented a Large Scale Asset Purchase programme from March 2020 as a response to the economic impacts of Covid. They purchased low interest-bearing government securities from banks and increased the banks’ deposit accounts at the Reserve Bank by the same amount.

It was a programme of money creation and it certainly lived up to the ‘large scale’ part of its name. The amount of government securities held by the bank increased from just under $5 billion in March 2020 to almost $52 billion in March 2021.

The banks’ deposit accounts at the Reserve Bank, which had averaged around $7.5 billion over the decade to 2020, peaked at almost $60 billion in January 2023. Not only were huge amounts of liquidity created quickly – but also, they are still in the system today despite the surge in inflation.

Since 2020, many interest rates have shot up because of the Reserve Bank’s monetary policy tightening. The Reserve Bank pays the banks the Official Cash Rate on the banks’ deposits with it.

It was only 0.25% in 2020 when the programme started but is now 5.25%. However, the interest rates on the government securities the Reserve Bank bought from the banks haven’t risen. That’s why the programme’s cost is currently $10.5 billion – and will go higher if the Reserve Bank increases the OCR again on 24 May.

Could the Reserve Bank have anticipated that its programme was going to be costly for the government? Absolutely. They must have thought that their low-interest rate and money creation policies were going to support and raise economic activity, or they shouldn’t have implemented them in the first place.

They must have known that as economic activity increased, they would need to move interest rates back to a more neutral level from their unprecedented low level. Given this, the ‘least regrets’ policy should have been to inject liquidity relatively slowly and to turn off the money creation tap as soon as the first signs of rising inflation appeared.

The Reserve Bank did neither. They pumped in huge amounts of liquidity quickly and a lot of it did nothing more than sit in the banks’ deposit accounts at the bank. They didn’t turn off the tap until late 2022, by which time inflation was already over six per cent.

The programme was helpful in maintaining confidence and economic activity in the face of a pandemic. But it didn’t need to cost the country over $10 billion. The cost is only this high because of poor decisions made by the Reserve Bank.

I wonder if they have any regrets about that today. From their public statements, it doesn’t seem they do. But the taxpayers, who are going to have to meet the bill, certainly should have regrets. Imagine the useful ways in which that $10.5 billion could be used if it wasn’t being used to prop up banks’ profits. It could have been spent on things like education or health or government debt could be reduced substantially.